Reminder From The Innovator's Dilemma: Markets Change Whether You Like It Or Not

from the deny-at-your-own-risk dept

It’s hard to think of a book more influential to business strategic thinking than Clayton Christensen’s The Innovator’s Dilemma. If you haven’t read it (or grasped the concept), you are way behind anyone in thinking about innovation and competitive markets, especially in the technology world. I’ve talked about it in the past, and I’m sure many of you are familiar with it, or have read it, but I’m reminded of one of the key points made in the book that seems to be a key stumbling block in some of the discussions we have around here. The reminder comes from a blog post that Jay Rosen recently mentioned, talking about Christensen’s main point, in relation to the new industry, focusing mainly on why so many companies fail at innovating:

The management trap of disruptive technology is insidious because, like all good traps, it doesn’t look like one at first. It looks prudent and fits a corporate culture of conservative, data-driven management. But incumbents can’t recommend change because it would mean recommending something less profitable, less accepted, and less proven than what they’re already doing.

And that’s the trap.

Disruptors have no such inhibitions.

This is the key point, and while I’m not going to talk about what that post is actually discussing (the failure of some companies to be able to innovate due to this issue), I am going to use it to try to make a particular point, and hopefully clear up a misperception. There are two points that we’re often trying to make around here, and the problem is that those two points often get conflated.

- What’s happening in the market is going to happen anyway.

- The end result will actually be better for everyone, which is why it’s important to embrace the innovation

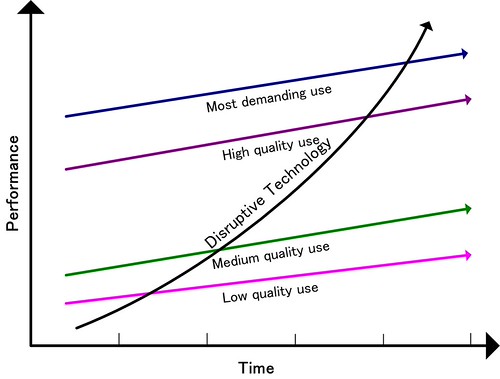

The two points are related — and, it’s actually one of the key points made in Christensen’s famous chart — but they are different points:

But, the second point is also important. Historically, pretty much every disruptive innovation has followed Christensen’s curve, meaning that the eventual outcome really is a better overall solution for the market, and thus makes the market much bigger, even if it doesn’t look that way at first. But, the problem is that it’s difficult to see that. So, when we get industry defenders (whether it’s the recording industry, the movie industry, the newspaper industry or others) insisting that it doesn’t make sense to jump off that cliff and embrace these new offerings, because the market just isn’t big enough (or, as short-sighted Hollywood execs have taken to saying: “turning analog dollars into digital dimes”), we note that they’re absolutely making the management trap described above.

They’re refusing to make the leap because of a misunderstanding of both of those points — but they’re often focusing too much on arguing against point two, that they ignore point one. If you want to believe that point two isn’t true, that’s fine (even if you turn out to be wrong). That doesn’t excuse not being able to respond to point one. If you really think that the market is turning into digital dimes, you at least need to do something about point 1: what are you going to do about it. Because, for the most part, it seems like those legacy industry’s aren’t doing a hell of a lot, other than complaining about what’s happening, and then confusing that with point number 2.

They’re refusing to do anything because they think that the new market is too small — not realizing that the existing market is going to zero anyway. So even if you believe that the new market isn’t going to be as big (on which point you’re almost certainly wrong), you’re making a mistake in thinking you can just do nothing. What’s happening is you’re comparing the new market to the old market — which no longer exists.

Filed Under: clayton christensen, innovator's dilemma

Comments on “Reminder From The Innovator's Dilemma: Markets Change Whether You Like It Or Not”

Who's doing nothing?

A market provider in a current-being-disrupted market must evaluate what they have the expertise to provide to the next iteration of the market.

There are many providers in the entertainment market that know full well, they have nothing of value to offer the next iteration of the market, and this is the key reason why they are trying to stalwart the change.

The next iteration of the market will not belong to them.

I am hoping the next iteration belongs to me ... GRIN

I see couple main points that can change or remove the media groups strangle hold ….

1) Open Accounting standards

2) Open Programming Standards

fiduciary responsibility

Arent they legally bound to provide the GREATEST RETURN to shareholders? If they act in any other way, arent they guilty of a crime? Embracing a model that reduces returns then is something they couldnt do, even if they wanted too.

Re: fiduciary responsibility

I believe they’re guilty of ‘breach of contract’ (or something like that) in such a scenario.

Re: fiduciary responsibility

“Arent they legally bound to provide the GREATEST RETURN to shareholders?”

Absolutely, but if you look at the graph, that’s the point: if these guys would take the long view, which method is going to eventually bring the greatest return? The stuff that worked yesterday? Or the stuff that will work tomorrow?

But maybe that’s the problem: these CEOs are responsible for reporting to major stockholders, probably largely bank representatives in a lot of cases, that think in terms of slow plodding percentage points, not disruptive and quick innovation.

Re: Re: fiduciary responsibility

Absolutely, but if you look at the graph, that’s the point: if these guys would take the long view, which method is going to eventually bring the greatest return?

No. If you look at the graph, it represents the whole market. NOT the individual players.

Disruptive markets are called disruptive because they change the market, as well as the market leaders.

Re: Re: Re: fiduciary responsibility

“Disruptive markets are called disruptive because they change the market, as well as the market leaders.”

Isn’t that true if and only if the market leaders fail to embrace the disruptive market? What if the jump on the board and transition to the disruptive market/technology?

In fact, it seems to me that the most profitable solution is to figure out which of the non-disruptive lines your business is on, and then transition as close to the intersect point as possible, no?

Re: Re: Re:2 fiduciary responsibility

never happens. 99 times out of 100. Usually ceo’s deal with upper management who are extremely incompetent, afraid of change, afraid of new ideas, etc. “lets stick with what works because it has before” is a stockholder motto. Think MS would get some pushback if for whatever reason they tried to open source windows, for example?

Other examples are hidden costs who upper management will turn into heresy on their own. “training costs, shifting costs”, etc just to block out new ideas.

Re: Re: Re:3 fiduciary responsibility

change that to “almost never happens” and I’m with you.

And even if a company gets nimble, adapts to the new paradigm, and accepts that disruption is inevitable, AND is successful in the new world order. It is unlikely that the individual firm will be AS successful as they were in the status quo.

Put it this way: if you’re #1, how appealing does change sound to you? I mean, you only have one way to change…down. Similar things occur with senators and congresspeople: how much do they want to reform the electoral system? The same sytem in which they have learned to come out as winners? Not at all! Equitable change for them means a change from winning to not winning, and that won’t get their vote.

People at the top, people earning unreasonably high economic rents, monopolists, people with locked-in IP rights, people making money off the status quo…these people will never favor change.

And BTW, CEOs are not “legally bound to provide the GREATEST RETURN to shareholders.” They are only bound to TRY to do this, as best as they can. Failure is not a crime, nor should it be.

Re: Re: Re:2 fiduciary responsibility

Isn’t that true if and only if the market leaders fail to embrace the disruptive market? What if the jump on the board and transition to the disruptive market/technology?

No, not really. When the personal-transportation market was changing from buggys to automobiles the buggy makers had absolutely nothing to offer to the new market.

The expertise that was brought to the market by the buggy makers was how to work wood into something that could be dragged by a horse with the greatest efficiency. This expertise was no longer required when the market was disrupted by the combustion engine.

What the current entertainment providers bring to the market current is the micro-management of distribution. That’s all. Distribution is no longer difficult to manage. All managers of distribution are no longer required. Everyone of them will fall by the wayside, as the world needs them no more.

No matter how much they WANT to do something else.. they don’t know how. Their skillset includes one thing. Managing distribution. They have no other skillsets with which to leverage in the next iteration of the market.

Don’t be fooled with all the other things that the entertainment people did. That was not their expertise. Everything else was a loss leader for their one and only strength: managing distribution.

Re: Re: Re:3 fiduciary responsibility

When the personal-transportation market was changing from buggys to automobiles the buggy makers had absolutely nothing to offer to the new market.”

And yet, I remember reading about a buggy maker who started making cars anyway, and succeeded. Just the strength of the name was enough to provide a huge boost to any old but respected company who made the effort to embrace the new disruptive technology. The ones who failed are the ones who didn’t even make the effort.

What the current entertainment providers bring to the market current is the micro-management of distribution. That’s all.

That’s simply not true. There’s still plenty of room in the new economy for multi-billion dollar corporations with connections to artists, producers, marketing and yes, even distribution resources, and countless other industry connections. Any major record label today could embrace these disruptive technologies and would have an incredibly huge head start over anybody else who wanted to provide services to artists.

Of course, to survive they’d have to focus on giving both the artists and the fans what they want. (Giving people what they want can be extremely profitable; in a competitive industry, it’s the only thing that is. Only when competition is restricted can companies profit without considering what either their suppliers or their customers are looking for.)

Re: Re: fiduciary responsibility

For all the reasons mentioned, most large companies aren’t going to make the jump (or start to make the jump) until the market reaches the middle of the curve or higher, and by then it’s likely too late.

It’s not just management, CEOs, Boards of Directors, and stockholders that have to be convinced to look beyond quarterly profits, but investment markets in general. If companies don’t meet quarterly profit projections, they get hurt. That happens often enough and management gets fired.

About the only thing that will make these companies deal with the changing market in meaningful ways is if they’re profits really tumble. And even then, only the forward-looking businesses that have already started the process of managing change (assuming they’ve fully realized Mike’s first point) will be in a position to recover.

The wise managers would be maximizing revenue in the legacy market while ramping up plans for exploiting the new market.

Re: fiduciary responsibility

only if they are focused on the next quarter’s results and not the long term viability of the enterprise. too many companies only look at the next quarter and fall off the cliff.

The obligation of fiduciary responsibility says nothing about timeframe – there is no obligation to maximize the next quarter’s results.

Investing in the long-term future of the firm, so that future profits will be higher, is entirely responsible.

That aside, going after management for breach of fiduciary responsibility in a case like that is just about impossible – it’s not a case of outright fraud, it’s a matter of judgment and opinion.

Re: Re:

True, however companies that invest 10% of their gross into research and development have shown time and again that they can weather market fluctuations much better than companies that invest say 1-2%. Running a company based on the past is like driving a car solely by looking thru a rear-view mirror. A crash is inevitable. And that may be where obligations are not met, and management needs to be held accountable.

Re: Re: Re:

True, however companies that invest 10% of their gross into research and development have shown time and again that they can weather market fluctuations much better than companies that invest say 1-2%.

irrelevant. companies that do not invest in research at all have more money to pay quarterly dividends. since the 80’s you run a business just like you a football game: one quarter at a time. this is why CEO’s change companies after two years: they either have a few good quarters and can leave for better paying positions, or they have a few bad quarters and get replaced.

sure, they teach you all about growth and value in business management classes, but the practical reality is that you have to produce profits at to the detriment of everything else.

Running a company based on the past is like driving a car solely by looking thru a rear-view mirror. A crash is inevitable.

also irrelevant. if a company is big enough, or has enough politicians invested in it, it will get bailed out if it crashes. if the company is too small for a bailout, then no one cares. there is no reason to look past the current quarter and deliver those quarter point increases.

And that may be where obligations are not met, and management needs to be held accountable.

wow, the irrelevance trifecta.

corporate managers will not be held accountable for anything and you know it.

the stockholders won’t take any bold moves against management for fear that word leaks out and the stock price falls.

the media won’t publish anything because of all the brokerage and bluechip advertising that they will lose.

so no, there is no reason to innovate thanks to help from the government, and there are no repercussions for failure because the shareholders and the business media are both complicit.

Re: Re:

Exactly…if the shareholders don’t think that the judgment and opinions of the board and officers are in the best interests of the company, then there are mechanisms to remove them.

That’s kind of what being a shareholder is all about.

Re: Re:

“The obligation of fiduciary responsibility says nothing about timeframe “

but the expectations of modern Boards do, all they want to know about is this quarter and next quarter (and really the stock price TODAY). If you want thinking beyond that timeframe, you have a bigger problem then just intelectual property issues, you have to change the entire corporate mindset (and that of investors). They dont pay CEO bonuses based on profits they might see 10 years in the future (since Enron anyway), so why should the CEO care about them (he wont be there more then 5 years anyway).

phrasing from one of my websites I frequent

“Don’t worry, change is scary but you’ll adapt.”

Kodak Moment

I noticed today on CNBC that Kodak is in jeopardy of being delisted from the S&P 500 because it is too small. At one point, Kodak was King, but it appears they did not innovate due to all the reasons listed above. They are now a forgotten company that has been replaced by innovators.

Re: Kodak Moment

They did not transition to digital photos well at all. They were too associated with analog film, and allowed the tech companies and steal their association with photography in general from under them. And now single-use cameras are dominated by generic brands & Kodak isn’t really sought after for much of anything anymore.

Where as Polaroid has innovated tremendously in both the remaining analog film niche markets as well as the digital markets, and has maintained at least some level of mindshare. And they were in particular threat as the previous leader in instant photography that digital cameras were aggressively attacking with LCD screens & portable photo printers.

Really good example to point out, and I find an interesting contrast against Polaroid. Fujifilm is another example of a company that was able to make a successful transition from analog to digital photography.

Re: Kodak Moment

..if they’d just pay attention to the Recording Industry, they’d have quickly moved to outlaw digital cameras.

Fools.

/sarcasm

Re: Re: Kodak Moment

sarcasm? How about “missed the target”. Is isn’t the medium that is an issue (music has gone from wax to vinyl to cassette to cd without major issue). The issue is the product ON those medias, not the media.

Digital delivery wouldn’t be a problem, except that DRM is so hated. You basically want the music business (and the movie business) to put their product out there in the clear where anyone can take it for free, and expect them to keep producing the high quality product they always have – and you expect them not to complain?

sarcasm indeed.

Re: Re: Re: Kodak Moment

“Digital delivery wouldn’t be a problem, except that DRM is so hated. You basically want the music business (and the movie business) to put their product out there in the clear where anyone can take it for free, “

Yeah, like Broadcast radio . . . its a radical new idea I know but they need to come to grips with it.

Re: Re: Re: Kodak Moment

You basically want the music business (and the movie business) to put their product out there in the clear where anyone can take it for free

didn’t you get the memo?

it’s already out there, in the clear, where anyone can get it for free, right now. if people are going to get it for free anyway, they might as well be getting it from you instead of someone else.

“The end result will actually be better for everyone, which is why it’s important to embrace the innovation”

There is little proof available that the trashing and destruction of the music and movie industries will be better for everyone. In reality, the few that it may help (amateur musicians and film makers) doesn’t make up for the tremendous losses on the other side.

Imagine the movie Titanic as an MTV video. That’s pretty much where this is headed.

The other part is that there is little “innovation” in the current wave of free, rather destruction, duplication, and removal of the monies that would have helped to fuel innovation.

It seems like a lose-lose.

I don’t think this theory works very well when the disruptive force is widespread thieving and misappropriation of works.

Re: Re:

“Imagine the movie Titanic as an MTV video. That’s pretty much where this is headed.”

Im not sure that 200 million snooze fest is your best example

Re: Re: Re:

Would you prefer “Gone With The Wind” with amateur actors filmed in a local park? Perhaps starwars done South Park style? Maybe the Godfather trilogy on a hi-8 camcorder filmed in a new york parking garage at night?

There are a dozen or more “blockbuster” movies releases every year, which could not be imagined on a budget of “2 pizzas and a case of beer”.

Re: Re: Re: Re:

‘Gone With The Wind” with amateur actors filmed in a local park? Perhaps starwars done South Park style? Maybe the Godfather trilogy on a hi-8 camcorder filmed in a new york parking garage at night?’

as I recall, starwars was famously done independantly. George Lucas always said the best thing that ever happened to him was the inability to raise substantial financing, so he ended up pretty much owning the thing. Now major deals had to be made for disribution, but this was not becuase of a need for money, but becuase the film distribution system was a closed oligopoly. South Park creators on the other hand have no problem raising money and I would assume could easily raise the money to make any rediculous movie they care too in our current system. I take it your argument is that the current system gives us the best possible quality products . . . I find that really hard to believe.

Re: Re:

There is little proof available that the trashing and destruction of the music and movie industries will be better for everyone. In reality, the few that it may help (amateur musicians and film makers) doesn’t make up for the tremendous losses on the other side.

The music and film industries are not at risk. It’s just the specific part of them that’s managed by the studios and record labels that’s at risk, and there’s nothing that can save those anyway. Their role is no longer necessary, so trying to hold onto it doesn’t benefit anyone.

As far as making up for their losses, I don’t see why that’s necessary, either. From the perspective outside the company, what is there to “make up” for? Their losses aren’t shared.

Re: Re:

There is little proof available that the trashing and destruction of the music and movie industries will be better for everyone. In reality, the few that it may help (amateur musicians and film makers) doesn’t make up for the tremendous losses on the other side.

make up for losses? those industries made billions in the past and now the market has changed. there is nothing to make up for; the game is over. it’s time for your generation to pick up your toys and go home because the next game is starting and the new players are taking the field.

the days of investing millions in a single project in order to earn more millions is over. that well went dry and now it’s time to find another one.

The other part is that there is little “innovation” in the current wave of free, rather destruction, duplication, and removal of the monies that would have helped to fuel innovation.

go cry to someone else. the big studio/label days are over. figure out how to profit from today’s market based on today’s realities, or go out of business. 1997 is over and it isn’t coming back and no amount of crying will change that.

the future is in drastically smaller investments in drastically larger numbers of infinitely diverse media projects. that’s the innovation: cheaper and faster production, cheaper and faster distribution, and tons of collaboration.

if your movie only costs a million to make, then you only have to do 2 million in box office sales and merchandise to see a 100% return. i know the thought of only clocking a million dollars on a film seems like a small amount, but a 100% return is nothing to sneeze at. if you can repeat that process a couple of thousand times, you have your billions in profits that people like you are so hung up on.

take your costs down to 10k per project, and suddenly the potential for profit is even greater.

It seems like a lose-lose.

I don’t think this theory works very well when the disruptive force is widespread thieving and misappropriation of works.

cry some more. you are looking at big labels and studios like they are all the media and money in the world. there is a whole lot more to industry and creativity than big corporations and file sharing.

with myopic automatons like you in their employ, it’s no wonder your corporate overlords are going broke.

how markets change

The statement that “markets change whether you like it or not” is seductive and deceptive. Because what changes is the behavior of customers and suppliers in the market. Somewhere, there’s always a ‘you’ that likes it, or else nothing happens.

The key question for firms isn’t “How do I respond to the availability of this new shiny thing?” but “How do I respond to changes in my customers’ and competitors’ behaviour?”

Horse and Buggy.

To: JJ (Re: Re: Re: Re: Re: fiduciary responsibility, Aug 25th, 2009 @ 10:47am):

The business about the horse buggy makers has been repeated over and over, and everyone seems to misunderstand it.

Buggy makers typically adapted to the automobile by becoming subcontractors making bodies for automobiles. Winton was an exception in becoming an automaker in its own right. Becoming a subcontractor wasn’t a very big deal for the buggy maker because an auto body, circa 1900, was very much like a buggy. In 1900, a typical buggy might have cost about fifty dollars– say, $2500 in modern money. That was small compared to the price of an automobile. It was also small compared to the cost of a horse and buggy. A good ninety percent of the cost of a horse and buggy was the horse, not the buggy. That especially meant the ongoing expense of the horse’s food. Someone who made his living riding or driving might require a herd of anything up to a hundred horses, in the case of heavy hauling or stagecoaches. RFD mail carriers, who had to go twenty-four miles a day, tended to keep several horses and change them annually, spending hundreds of 1900 dollars in the process each year (tens of thousands in modern money). A cowboy would have a “remuda” of ten horses. The horses wore out, and had to be changed frequently. (See James Bruns, _Motorized Mail_, Andy Adams, _Log of a Cowboy_).

It was the horse, and the horseman, that had to deal with change, not the buggy maker. Originally, the blacksmith’s bread-and-butter had been shoeing horses, and making simple agricultural implements. Blacksmiths tended to become welders and mechanics, both of automobiles and of modern agricultural implements such as harvesters. Being a mechanic implied welding broken parts back together, so the trades were linked. See Douglas Harper, _Working Knowledge: Skill and Community in a Small Shop_. Veterinarians, the other major skilled trade, took a different path. Look at James Herriot’s various books (_All Creatures Great And Small_, etc.). They tended to move towards “small animal practice,” ie. dogs, cats, and tropical birds. The farmers who bred horses and provided food for them tended to shift towards other crops, depending on their peculiar geography. The “horse industry” ceased to exist as its members went off in different directions, according to their different skills and aptitudes.